If your finance team is bogged down by manual processes, what’s being overlooked? Delayed decisions, missed opportunities, and increased risks.

In today’s fast-moving business environment, finance teams are under constant pressure. Manual processes consume time, increase the chance of errors, and slow decision-making, impacting overall business performance. Companies are expected to close their books quickly, manage cash flow efficiently, and adapt to real-time market changes. Yet, many still rely on outdated systems that hold them back.

This is where digital finance transformation comes in. By adopting AI-powered automation, businesses can move from routine tasks to strategic decision-making. Automation speeds up financial reporting, improves cash flow forecasting, and boosts financial flexibility. Despite these advantages, many organizations remain hesitant to make the change.

I’ve seen firsthand how digital finance transformation isn’t just about efficiency but survival. John Chambers, former CEO of Cisco, didn’t sugarcoat it when he said,

“At least 40% of all businesses will die in the next ten years… if they don’t figure out how to change their entire company to accommodate new technologies.”

If you ignore this, your competitors will leave you behind. Those adopting SAP S/4HANA and AI-driven automation are cutting costs, making smarter decisions, and staying ahead in the digital age.

I’m Seema Kutal, a finance transformation expert specializing in SAP-driven digital finance solutions. Over the years, I’ve helped companies transition from manual, fragmented financial processes to intelligent, automated workflows that drive efficiency and accuracy.

In this article, I will explore how digital finance transformation impacts business performance, identify key KPIs to measure success and explain how SAP S/4HANA drives this shift across industries.

Understanding Digital Finance Transformation

Digital finance transformation isn’t just an upgrade—it’s a shift from manual number crunching to real-time, AI-driven decision-making. It turns finance teams from data processors into strategic advisors.

At the center of this shift is SAP S/4HANA, a cloud-based ERP system built to streamline financial operations, enhance reporting accuracy, and increase agility. With the 2408 release, SAP introduces embedded KPIs, predictive analytics, and automation tools that accelerate closing processes, improve forecasting, and provide deeper spend visibility across global entities.

These innovations are further strengthened by updates in the 2402 edition, which enhance productivity through AI-powered invoice processing, real-time data access, and intelligent treasury insights. This enables finance teams to act faster, reduce risk, and focus on strategic priorities.

Businesses investing in digital finance transformation operate more efficiently, accurately, and at a grander scale. Automation eliminates repetitive tasks, freeing finance teams to focus on high-value strategic initiatives.

Taken together, the insights from SAP’s S/4HANA Cloud Public Edition (2408 and 2402) highlight a broader trend of using AI and real-time data to transform financial operations. These tools not only improve reporting accuracy and streamline processes but also equip finance teams with the agility and foresight needed to enhance cash flow management and quickly adapt to market changes.

The integration of predictive analytics and AI-powered invoice processing exemplifies how automation boosts efficiency, enabling finance teams to focus on higher-value, strategic tasks.

As George Westerman from MIT Sloan describes,

“When digital transformation is done right, it’s like a caterpillar turning into a butterfly, but when done wrong, all you have is a really fast caterpillar.”

Do it right, and your finance team will become a decision-making powerhouse. Do it halfway, and all you’ve got is a slightly faster version of the same old process.

How Digital Finance Transformation Improves Business Performance

Digital finance transformation enables companies to unlock efficiencies, reduce costs, and shift finance teams from transactional work to strategic value creation.

One recent example is Deloitte’s case study with reMarkable, a fast-scaling tech company. The organization eliminated operational bottlenecks by implementing SAP S/4HANA Public Cloud and gained a scalable platform to support growth. While the transformation was enterprise-wide, it also enabled real-time access to financial data and tighter alignment across business functions—key enablers of modern finance excellence.

SAP solutions like SAP Central Finance, SAP Analytics Cloud, and SAP Business Technology Platform (BTP) allow companies to integrate financial data across global entities, automate complex forecasting models, and ensure regulatory compliance with AI-driven audit trails. These tools enable CFOs to gain real-time financial insights, improving short-term cash flow management and long-term investment strategies.

Moreover, SAP’s AI-powered automation and blockchain security capabilities enhance business resilience by reducing financial risks. AI-driven anomaly detection helps prevent fraud, while blockchain-based transaction validation ensures transparent and secure financial reporting.

According to the 2402 insights on SAP S/4HANA Cloud Public Edition, these technologies empower organizations to streamline financial operations, enhance reporting accuracy, and achieve greater scalability across functions. By leveraging AI-driven automation and integrated analytics, businesses can improve operational efficiency, reduce errors, and adapt swiftly to changing market conditions.

Together, the Deloitte case study and Ulrich Hauke’s insights illustrate a growing trend in digital finance transformation: the shift from manual, fragmented financial processes to integrated, AI-powered automation.

Deloitte’s work with reMarkable shows how SAP S/4HANA Public Cloud improves operational efficiency by enabling real-time access to data, while Hauke’s insights reveal how these tools drive accuracy and agility in financial reporting. These innovations empower finance teams to move from transaction-based tasks to more strategic, data-driven decision-making, ultimately enhancing overall business performance and scalability.

Leveraging these technologies can help companies scale their financial operations efficiently, reduce reporting errors, and create a more agile finance function that can adapt to changing market conditions.

By embracing digital finance transformation, organizations improve efficiency and future—proof their financial ecosystems for sustainable growth in an increasingly competitive and data-driven economy.

Key Performance Indicators (KPIs) for Measuring Digital Finance Transformation

What does success look like in digital finance transformation? SAP S/4HANA users cut that down to 1-2 days. AI-powered forecasting improves accuracy by up to 50% so that finance teams can plan with confidence instead of guesswork.

One critical KPI is reducing financial close time. Companies using SAP S/4HANA typically shorten their close cycles from 5-10 days to 1-2 days, improving operational efficiency.

Another key metric is operational cost efficiency. A Deloitte report found that businesses implementing digital finance solutions can cut transaction costs by 20-40%.

Another critical measure is cash flow forecasting accuracy. AI-driven finance models improve prediction accuracy by 30-50%, giving finance teams greater confidence in planning and budgeting.

Additionally, SAP provides a Financial Statement-Based KPI Dashboard, which helps organizations monitor real-time performance metrics and make data-driven decisions.

Success in digital finance transformation is reflected in key measurable outcomes. One of the most critical is the reduction in financial close time. According to an industry insight article published by SAP finance expert Paras Arora on LinkedIn, companies leveraging SAP S/4HANA have achieved up to a 50% decrease in close cycles, allowing finance teams to shift from manual tasks to more strategic roles.

Operational cost efficiency is another crucial KPI. Organizations have streamlined data entry and reconciliation processes by automating routine tasks through SAP S/4HANA’s Advanced Financial Closing capabilities, leading to cost reductions and improved accuracy.

A report by JPMorgan Chase highlights how AI-driven forecasting models can reduce error rates by up to 50% compared to traditional approaches, empowering finance teams to improve planning accuracy and strengthen liquidity management.

By focusing on these KPIs, organizations can effectively measure and enhance the impact of their digital finance transformation initiatives.

Insights from SAP, Deloitte, JPMorgan, and Paras Arora highlight a clear trend in digital finance transformation: AI and automation are improving operational efficiency, reducing costs, and enhancing forecasting accuracy.

Overcoming Challenges in Digital Finance Transformation

While digital finance transformation offers significant benefits, businesses often face obstacles that slow adoption. The most common challenges include workforce resistance, data migration complexities, and cybersecurity concerns. Effectively addressing these issues is essential to realizing the full potential of SAP S/4HANA and other digital finance solutions.

Addressing Workforce Resistance

Change isn’t easy, especially when it feels like automation is replacing people. Finance teams worry about job losses, and leaders hesitate and are unsure how to roll out new systems. But resistance isn’t the problem; the problem is a lack of training and support.

A phased implementation approach can ease resistance—starting with automating repetitive tasks before introducing more complex financial processes ensures a smoother transition. Early wins help build confidence and accelerate broader adoption across finance teams.

Managing Data Migration Complexities

Shifting financial data from legacy systems to SAP S/4HANA can be challenging, especially with inconsistent accounting structures and incomplete historical data. Poor migration strategies can disrupt financial reporting and delay transformation timelines.

To ensure a smooth transition, businesses should also:

- Assess data readiness before migration to resolve inconsistencies.

- Use SAP’s AI-powered data validation tools to prevent reporting errors.

Strengthening Cybersecurity & Compliance

As finance moves to the cloud, organizations must proactively secure financial data and comply with IFRS, GDPR, and SOX regulations. Cyber threats and regulatory fines pose risks to businesses that fail to secure digital finance operations.

SAP’s Risk and Compliance Solutions address these concerns by offering:

- Automated compliance tracking to meet financial regulations.

- AI-driven fraud detection to identify suspicious transactions.

- End-to-end encryption to protect sensitive financial data.

By leveraging SAP security features and proactive monitoring, businesses can protect financial data, ensure compliance, and minimize security risks during digital transformation.

Why Businesses Must Act Now

I’ve seen how every delay in upgrading finance systems costs businesses money. When companies digitize their finance operations, they often cut costs by 42% and make better strategic decisions. But those that don’t? They fall behind—and I know from experience that catching up isn’t cheap.

Digital finance transformation helps organizations reduce operational costs, improve forecasting accuracy, and strengthen financial resilience. AI-powered analytics drive smarter decisions, optimize cash flow, and help businesses stay agile in response to regulatory shifts and market volatility.

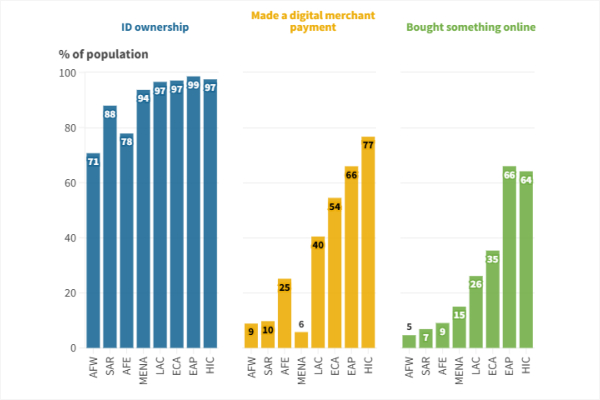

This global trend toward digital payments and online transactions reinforces the urgency. As digital adoption accelerates across regions—from mobile money in Africa to online purchasing in East Asia—finance systems must evolve. Businesses that delay transformation risk falling behind markets already operating with real-time data and intelligent automation.

Finance leaders must evaluate current processes and invest in intelligent, scalable solutions like SAP S/4HANA, SAP BTP, and SAP Analytics Cloud to build agile finance functions that thrive in a dynamic business environment.

Seema Kutal – Author

She is a finance transformation expert with over 15 years of experience in SAP S/4HANA and AI-driven finance automation. She has led global SAP finance projects for Fortune 100 companies, optimizing financial operations through automation, data-driven insights, and predictive analytics. She is passionate about mentoring finance professionals and contributing to SAP innovation initiatives.